Federal withholding calculator 2023 per paycheck

An individual or deceased person who is or was a nonresident noncitizen of the United States for estate and gift tax purposes may still have US. You may also owe state unemployment tax.

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS.

. That means you can collect at least some of any credit amount that is left over even if your federal income tax bill has been reduced to zero. If you get laid off from your job and stay unemployed the rest of the year you likely had too much tax withheld while you were working. Youll see your social security number Box A name Box E and address Box F appear here while your employers employer identification number EIN Box B name and address Box C and control number Box D if any appear here as well.

The decision to send your child to a public or private school is a personal choice. Youll really see a tax benefit though when you send your child to college. Your bracket depends on your taxable income and filing status.

505 Tax Withholding and Estimated Tax. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Give Form W-4 to your employer.

January 2020 which provides nonresident aliens who are not exempt from withholding instructions for completing Form W-4 and the Instructions for Form 8233. Federal estate and gift tax. The court might pay only 20 a day for jury duty meaning the juror would lose a net 100 a day in income 120 - 20 100.

This is the actual price paid per share times the number of shares 20 x 100 2000 plus any amounts reported as compensation income on your 2021 tax return 2500. The value cant be determined by multiplying a cents-per-mile rate times the number of miles driven unless you prove the vehicle could have been leased on a cents-per-mile basis. 10 12 22 24 32 35 and 37.

See Notice 2021-7 for more information on temporary relief for employers and employees using the automobile lease valuation rule to determine the value of an employer. Enter Personal Information a First name and middle initial. Terms and conditions may vary and are subject to change without notice.

Youll likely end up owing a late payment penalty of 05 per month or fraction thereof until the tax is paid. It will be updated with 2023 tax year data as soon the data is available from the IRS. Know how much to withhold from your.

Wages over 7000 a year per employee arent taxed. Forgiveness of Paycheck Protection Program PPP loans. Florida employers are responsible for withholding and paying the same federal payroll taxes as employers in the 49 other states.

Use Schedule H to figure your total household employment taxes. 51 Agricultural Employers Tax Guide. There are seven federal tax brackets for the 2021 tax year.

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for qualifying children ages 6 through 17. Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Terms and conditions may vary and.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Florida. 2022 federal income tax withholding. Your withholding is subject to review by the IRS.

A juror who normally earns 15 per hour and is not paid by the employer would lose 120 per day in regular earnings. Federal calculations will now use the official federal tax brackets and deductions and state calculations will use the most recent brackets available. 1040 Tax Estimation Calculator for 2022 Taxes.

There have been several major tax law changes as of tax year 2013 including several that are the result of new Obamacare-related taxes. If you settle on private K-12 schooling there are a few benefits that can help to reduce your federal tax liability and in some states your state tax as well. Beginning in 2018 the total amount of deductible state and local taxes including property taxes is limited to 10000 per tax year.

Mortgage Insurance Premiums Buyers who make a down payment of less than 20 of a homes cost usually get stuck paying premiums for Mortgage Insurance which is an extra fee that protects the lender if the. The adoption credit and the exclusion for employer-provided adoption benefits have both increased to 14440 per eligible child in. Know how much to withhold from your paycheck to get.

Both private and public post-secondary educations come with. The IRS will ask you what you can afford to pay per month. To receive a bigger refund adjust line 4c on Form W-4 called Extra withholding to increase the federal tax withholding for each paycheck.

Refund requests for tax withheld and reported on Form 1042-S. For the first half of 2022 the rate is 585 cents per mile and increases to 625 cents per mile for the last half of 2022. Please note this calculator is for the 2022 tax year which is due in April 17 2023.

Estate and gift tax filing and payment obligations. For more information see Pub. Use this simplified payroll deductions calculator to help you determine your net paycheck.

These boxes on the W-2 provide all the identifying information related to you and your employer. When you file your 2022 federal income tax return in 2023 attach Schedule H Form 1040 to your Form 1040 1040-SR 1040-NR 1040-SS or 1041. The federal tax return filing deadline for tax year 2021 was April 18 2022.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Self-Employed TurboTax Live TurboTax Live Full Service or with PLUS benefits and is available through 12312023. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA.

So if you get rehired in the same year. Refunds of certain withholding tax delayed. Before completing Form W-4 Employees Withholding Certificate nonresident alien employees should see Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens Rev.

Self-Employed TurboTax Live TurboTax Live Full Service or with PLUS benefits and is available through 12312023. These are the rates for taxes due. Self-Employed TurboTax Live TurboTax Live Full Service or with PLUS benefits and is.

This calculator is integrated with a W-4 Form Tax withholding feature. To fatten your paycheck and receive a smaller refund submit a new Form W-4 to your employer that more accurately reflects your tax situation and decreases your federal income tax withholding. Use TurboTaxs W-4 Withholding Calculator to determine the amount of withholding you should state on you and your spouses W-4s.

Enter your filing status income deductions and credits and we will estimate your total taxes. This publication supplements Pub. Before 2021 the credit was worth up to 2000 per eligible child and 17 year-olds were not eligible for the credit.

Youre unemployed part of the year. When you figure your estimated tax consider tax law changes effective in 2022. Know how much to withhold from your paycheck to get.

Know how much to withhold from your paycheck to. IT is Income Taxes. 15 Employers Tax Guide and Pub.

It describes how to figure withholding using the Wage Bracket Method or Percentage Method describes the alternative methods for figuring withholding and provides the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members. The Lifetime Learning credit The Lifetime Learning credit which can be as much as 2000 per tax return based on 20 of up to 10000 of qualifying higher-education expensesis available for an.

Paycheck Tax Withholding Calculator For W 4 Tax Planning

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

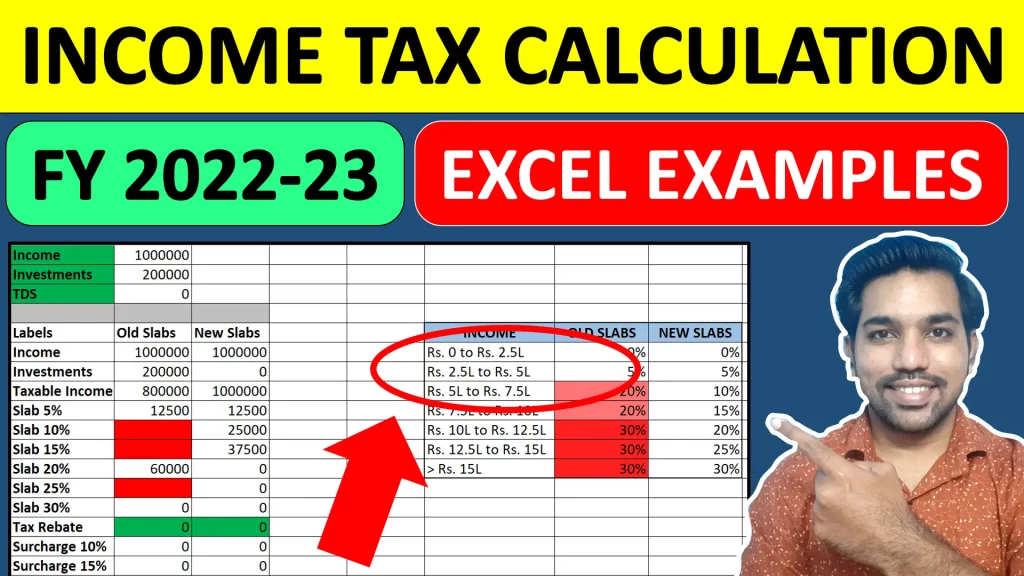

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

O Zed6uwug8jgm

When Are Taxes Due In 2022 Forbes Advisor

Could 2023 Social Security Cola Hit 9 Benefitspro

Calculator And Estimator For 2023 Returns W 4 During 2022

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Growing Your Tsp Retirement Benefits Institute Retirement Calculator Retirement Planner Retirement Benefits

2023 Va Disability Rates Projected Massive 8 9 Cola Increase Could Be Coming Va Claims Insider

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download Fincalc

Social Security What Is The Wage Base For 2023 Gobankingrates

Calculator And Estimator For 2023 Returns W 4 During 2022

Calculator And Estimator For 2023 Returns W 4 During 2022

2022 2023 Tax Brackets Rates For Each Income Level

Simple Us 2022 Federal Income Tax 2023 Tax Rebate Check Calculator